time:2024-02-05 source:高工锂电网

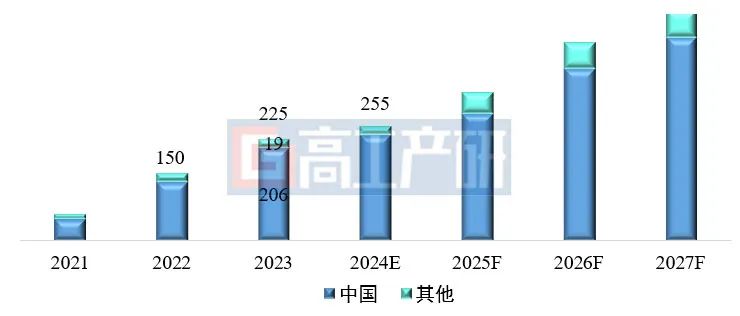

According to research data from GGII, the global shipment of energy storage lithium batteries reached 225GWh in 2023, a year-on-year increase of 50%. Among them, China's shipment of energy storage lithium batteries reached 206GWh, a year-on-year increase of 58%.

Global shipment volume and forecast of lithium energy storage batteries from 2021 to 2027 (GWh,%)

The proportion of domestic companies in global shipments has increased from 86.7% in 2022 to 91.6% in 2023. However, overseas companies such as Samsung SDI and LG Chemical, represented by Japanese and Korean chip companies, have no clear competitive advantage in shipment volume and their market share continues to decline. GGII believes that there are the following reasons:

1) Technical route and innovation advantages: In 2023, global fire accidents are frequent, and overseas integrators and battery companies are accelerating the switch from ternary to lithium iron phosphate routes. Compared to cylindrical ternary systems, square lithium iron phosphate has a higher safety advantage in energy storage applications. At the same time, the update iteration cycle of domestic energy storage cells has been shortened, and the iteration of technologies such as high-temperature cells and 300Ah+high-capacity cells has accelerated, with obvious innovative advantages;

2) Industry chain collaboration and cost advantages: Firstly, thanks to the collaborative support of the domestic lithium battery industry supply chain, energy storage enterprises have fully demonstrated their cost reduction advantages. Secondly, in 2023, multiple domestic lithium battery materials and cell enterprises have established factories in Europe, America, Southeast Asia and other regions, and industry chain collaboration helps enterprises reduce their overseas costs;

3) Downstream market and customer advantages: On the one hand, China is the world's largest energy storage market. In 2023, China contributed more than half of the world's new renewable energy installations, driving the rapid development of domestic energy storage. On the other hand, electricity storage (such as Sungrow Power, BYD, Tianhe Energy, etc.) and household energy storage (such as Huawei, Shouhang, Maitian, etc.) The market share of domestic integrators in segmented fields such as portable energy storage (Zhenghao Innovation, Huabao New Energy, etc.) is gradually increasing in overseas markets, driving the increase in the proportion of domestic supplier shipments;

4) Opportunities for foreign production capacity gap period: Both Europe and America have introduced local lithium battery industry chain protection policies aimed at developing local industries. However, due to insufficient construction experience, lack of bottom technology, incomplete industry chain, shortage of core talents, and high layout costs, the current industry progress is slow. At the same time, the IRA bill encourages enterprises to shift their new production capacity construction to the United States, and over 60% of lithium battery projects in Europe may face the risk of delay or cancellation. In the short term, the insufficient construction of domestic production capacity overseas has led to overseas integrators and owners signing contracts with Chinese battery companies in 2023, with annual contract orders exceeding 160GWh. GGII expects that with the gradual landing of domestic production capacity in the United States from 2025 to 2026, it will have a certain impact on the shipment of Chinese enterprises.

Although facing many risks, in the short term, going abroad to participate in global market competition is the only way for Chinese lithium battery industry chain enterprises to break through internal competition and become bigger and stronger.